Understanding Laen Eraisikult: The Benefits of Loans from Private Individuals

In today's financial landscape, traditional lending avenues may not always meet the diverse needs of borrowers. This is where the concept of laen eraisikult, or loans from private individuals, emerges as a viable alternative. This article delves deeply into the nuances of private loans, exploring their advantages, processes, and how they fit into the broader framework of financial services and real estate.

What is a Laen Eraisikult?

A laen eraisikult refers to a loan that is provided by a private individual rather than a financial institution like a bank. This shift from traditional banking can be appealing for many reasons:

- Flexibility: Loan terms can often be tailored to better suit the borrower's needs.

- Less stringent requirements: Private lenders may impose fewer qualifications compared to bank loans, attracting a broader range of applicants.

- Faster approval times: With fewer bureaucratic hurdles, private loans can often be approved more quickly than traditional loans.

The Growing Popularity of Private Loans

As financial markets evolve, laen eraisikult continues to gain popularity among individuals seeking funding. Factors contributing to this trend include:

1. Financial Independence

Many individuals prefer borrowing from private lenders to maintain their financial independence. By accessing funds from private sources, borrowers can avoid the strict oversight that comes with institutional loans.

2. Diverse Borrower Needs

Borrowers come from various backgrounds with differing financial situations. Private loans can cater to unique needs that banks might overlook.

Benefits of Laen Eraisikult

The advantages of securing a laen eraisikult extend beyond mere flexibility. Below are some key benefits:

1. Personalized Service

Private lenders often provide a more personal touch to the lending process. Understanding the borrower’s circumstances allows for tailored repayment plans.

2. Speed of Access to Funds

In urgent situations, the speed of acquiring funds can be decisive. Private individuals can expedite loan approval processes significantly, often providing funds in days rather than weeks.

3. Negotiable Terms

Unlike traditional loans with fixed terms, private loans often allow for negotiation on interest rates, repayment schedules, and loan amounts, which can mitigate financial strain on the borrower.

4. Less Paperwork

The traditional loan process often requires substantial documentation. In contrast, laen eraisikult typically necessitates minimal paperwork, shortening the time and effort required to secure funding.

How to Secure a Laen Eraisikult

It's essential to approach acquiring a laen eraisikult with well-informed strategies. Here’s a step-by-step guide:

Step 1: Determine Your Needs

Before seeking a private loan, identify your borrowing needs and how the money will be used. Common purposes include:

- Home renovations

- Debt consolidation

- Investments in real estate

- Emergency expenses

Step 2: Research Potential Lenders

Finding a trustworthy private lender is crucial. Look for recommendations, online reviews, and testimonials to ensure reliability.

Step 3: Discuss Terms Openly

Communication with potential lenders should be clear and transparent. Discuss interest rates, repayment terms, and any fees upfront.

Step 4: Negotiate the Agreement

Since one of the advantages of laen eraisikult is the opportunity for negotiation, don't hesitate to advocate for your interests in loan terms.

Step 5: Review the Contract Thoroughly

Before signing, carefully review all contractual terms and conditions to avoid any hidden surprises.

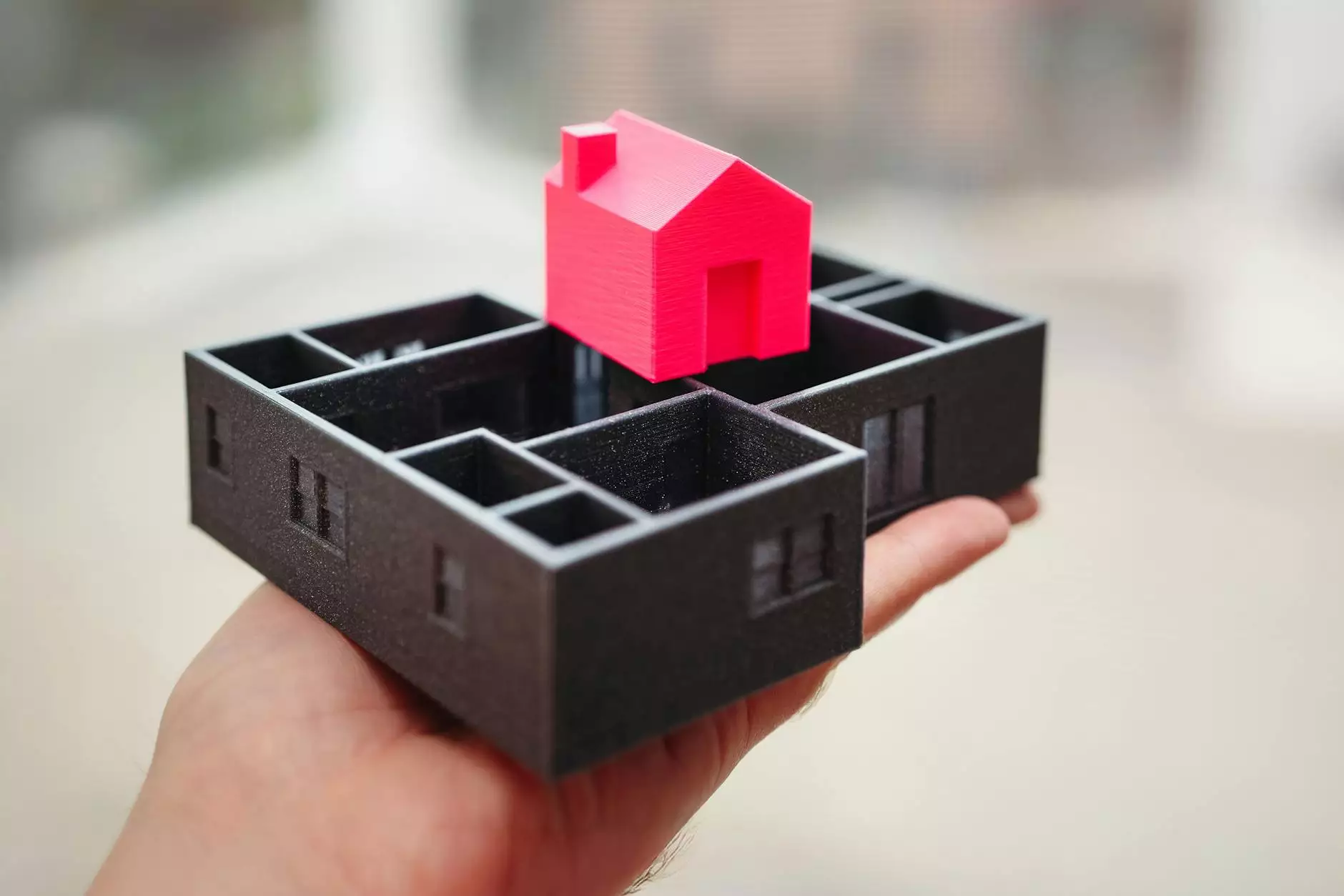

Impact of Private Loans on Real Estate Investments

Many investors leverage the advantages of laen eraisikult to fund real estate ventures. Here’s how private loans can impact the real estate market:

Quick Acquisition of Properties

In the competitive real estate market, timing is everything. Having access to private loans allows investors to act quickly and seize opportunities when they arise.

Flexibility in Financing

Real estate deals often require unique financing solutions. Private loans can be structured creatively to accommodate specific investment strategies.

Expansion of Portfolio

With the ability to access funds from private individuals, investors can grow their portfolios more aggressively, taking on multiple projects simultaneously.

Risks to Consider with Laen Eraisikult

While there are numerous benefits, it is also crucial to be aware of the risks associated with laen eraisikult:

1. Higher Interest Rates

Private lenders may charge higher interest rates than traditional banks, which can lead to higher total repayment amounts.

2. Informal Agreements

Without proper contracts or documentation, borrowers may find themselves in disputes with lenders over terms or repayment obligations.

3. Risk of Unregulated Lenders

Some private lenders operate without regulation, leaving borrowers vulnerable to predatory practices. It's critical to research and ensure your lender is reputable.

Conclusion: Navigating the World of Private Loans

In conclusion, laen eraisikult presents numerous opportunities for individuals seeking financial assistance outside of traditional banking systems. With the benefits of personalized service, quick access to funds, and flexible terms, it's a viable alternative that can support both personal and business financial needs. However, it’s essential to approach these loans judiciously, considering their potential risks and ensuring thorough research is conducted. By leveraging the advantages and being aware of the pitfalls, borrowers can utilize private loans to foster growth, particularly within the realm of real estate.

As the landscape of finance continues to evolve, platforms like reinvest.ee are poised to guide individuals through the intricacies of private loans and empower them to make informed financial decisions. Explore the possibilities that laen eraisikult offers as you chart your financial future.